The Definitive Guide for Pacific Prime

Wiki Article

The Pacific Prime PDFs

Table of ContentsAn Unbiased View of Pacific PrimeThings about Pacific Prime5 Simple Techniques For Pacific PrimeHow Pacific Prime can Save You Time, Stress, and Money.The Best Strategy To Use For Pacific Prime

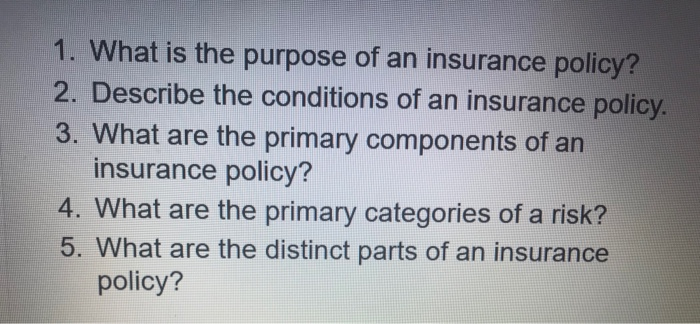

Insurance coverage is a contract, stood for by a plan, in which an insurance holder obtains economic protection or compensation versus losses from an insurance coverage business. Many individuals have some insurance: for their auto, their house, their medical care, or their life.Insurance coverage additionally helps cover expenses linked with responsibility (lawful responsibility) for damages or injury caused to a third party. Insurance policy is an agreement (plan) in which an insurance firm indemnifies one more against losses from specific contingencies or hazards.

Investopedia/ Daniel Fishel Several insurance coverage kinds are readily available, and virtually any private or company can locate an insurance provider ready to guarantee themfor a rate. Typical personal insurance coverage kinds are vehicle, wellness, homeowners, and life insurance. The majority of individuals in the USA have at the very least one of these sorts of insurance, and car insurance coverage is called for by state regulation.

The 5-Minute Rule for Pacific Prime

So finding the cost that is appropriate for you requires some legwork. The policy restriction is the optimum amount an insurer will pay for a covered loss under a plan. Maximums may be set per period (e.g., annual or policy term), per loss or injury, or over the life of the policy, also called the lifetime maximum.

Plans with high deductibles are commonly much less expensive due to the fact that the high out-of-pocket cost usually results in less tiny insurance claims. There are many various sorts of insurance. Allow's take a look at the most vital. Medical insurance assists covers regular and emergency situation treatment expenses, commonly with the alternative to include vision and oral services separately.

Lots of precautionary services may be covered for cost-free before these are satisfied. Health insurance policy may be bought from an insurance provider, an insurance coverage representative, the federal Wellness Insurance coverage Industry, supplied by a company, or federal Medicare and Medicaid protection. The federal government no longer requires Americans to have health and wellness insurance coverage, yet in some states, such as California, you may pay a tax penalty if you don't have insurance.

The 8-Second Trick For Pacific Prime

Rather than paying of pocket for vehicle crashes and damages, individuals pay yearly costs to an auto insurer. The company then pays all or most of the protected costs linked with a car accident or other automobile damages. If you have a rented lorry or obtained cash to purchase a car, your lending institution or renting car dealership will likely need you the original source to carry car insurance.

A life insurance policy plan warranties that the insurance firm pays an amount of money to your recipients (such as a partner or youngsters) if you pass away. In exchange, you pay costs throughout your lifetime. There are two primary sorts of life insurance coverage. Term life insurance policy covers you for a certain period, such as 10 to 20 years.

Insurance policy is a method to manage your monetary dangers. When you buy insurance, you buy protection against unexpected monetary losses.

4 Easy Facts About Pacific Prime Shown

Although there are several insurance coverage plan types, some of one of the most usual are life, health, home owners, and vehicle. The right sort of insurance policy for you will depend upon your goals and economic circumstance.

Have you ever had a moment while looking at your insurance plan or shopping for insurance when you've believed, "What is insurance coverage? Insurance policy can be a mysterious and perplexing thing. How does insurance coverage job?

Experiencing a loss without insurance can put you in a difficult economic circumstance. Insurance coverage is a vital economic device.

Pacific Prime for Beginners

And sometimes, like vehicle insurance and workers' settlement, you might be called for by legislation to have insurance in order to secure others - international travel insurance. Find out about ourInsurance choices Insurance is essentially a big nest egg shared by lots of people (called insurance holders) and taken care of by an insurance coverage provider. The insurer utilizes cash gathered (called costs) from its insurance holders and various other investments to pay for its procedures and to meet its guarantee to insurance holders when they sueReport this wiki page